It wasn’t long ago that the rallying cry for a generation of viewers was “cut the cord!” We were fed up with the bloated, expensive cable packages from legacy providers, forced to pay for hundreds of channels we never watched just to access the few we loved. The arrival of streaming services like Netflix, Hulu, and Amazon Prime Video felt like a liberation. It was an à la carte utopia: pay a low monthly fee, watch what you want, when you want, without commercials. The future of television was sleek, on-demand, and consumer-friendly.

But that utopia was short-lived. The success of Netflix sparked a gold rush, now famously known as the “Streaming Wars.” Every major media company, from Disney to Warner Bros. to Paramount, launched its own direct-to-consumer platform, pulling their valuable content from Netflix to build their own empires. The result for viewers? A fragmented landscape where subscribing to just a few services quickly surpassed the cost of the old cable bill.

Now, the industry is undergoing its most significant transformation since the dawn of streaming. The “Streaming Wars”—a period of aggressive, singular platform growth—are effectively over. We have entered the era of the “Great Re-Bundling.” Media companies are discovering that endless, standalone subscription growth has a ceiling, and they are now turning to a very old playbook: bundling services together to attract and retain customers.

This article will dissect this pivotal shift. We will explore the economic forces that ended the wars, analyze the new bundling strategies emerging in the market, and provide a clear-eyed projection of what this means for your wallet, your viewing habits, and the future of entertainment in America.

Part 1: How We Got Here – The Rise and Fall of the Streaming Utopia

1.1 The Golden Age of Netflix and the À La Carte Dream

In the early 2010s, Netflix was the undisputed king of streaming. For a mere $7.99 a month, it offered an unprecedented library of licensed content from various studios, all commercial-free. It was simple, affordable, and felt empowering. This period gave birth to the “binge-watch” and established a new relationship with television. Consumers felt in control, and the rapid decline of cable subscriptions seemed to confirm that the future was à la carte.

1.2 The Entrants Declare War: The Great Fragmentation

Seeing Netflix’s soaring valuation and subscriber numbers, legacy media companies realized they were leaving billions on the table. Why license your crown jewels (like “Friends” or “The Office”) to a middleman when you could build your own kingdom?

This led to a mass exodus of content and a flood of new services:

- Disney+ (2019): Leveraged its unparalleled brand power with Disney, Pixar, Marvel, and Star Wars.

- Apple TV+ (2019): Entered with deep pockets, focusing on high-quality, star-driven original content.

- HBO Max (2020): Combined the prestige of HBO with the vast WarnerMedia library.

- Peacock (2020): Banked on NBCUniversal’s broad content, from “The Office” to news and sports.

- Paramount+ (2021): Rebranded and fortified with CBS, Viacom, and Paramount Pictures content.

Suddenly, to watch the shows and movies you loved, you needed a half-dozen subscriptions. The à la carte dream had morphed into a “à la carte nightmare.” The average U.S. household now subscribes to four streaming services, and the collective cost began to sting.

1.3 The Wall Street Pivot: From Growth to Profitability

For years, Wall Street rewarded streaming services purely on subscriber growth. Companies burned billions on content to attract users, often operating their streaming divisions at a loss. But the market eventually soured on this model. With market saturation and rising interest rates, investors demanded a path to profitability.

The key metrics shifted from “subscriber adds” to “Average Revenue Per User (ARPU)” and operating income. This fundamental change in investor sentiment forced every streaming CEO to find a way to make money, not just gain market share. This was the death knell for the growth-at-all-costs “war” and the birth of the more pragmatic “re-bundling” era.

Part 2: The “Great Re-Bundling” – A New Era of Bundles, Partnerships, and Tiers

The “Great Re-Bundling” is not about going back to the 200-channel cable box. It’s a more digital, flexible, and complex evolution. Companies are using three primary strategies to increase revenue and lock in customers.

2.1 The Internal Bundle: The Mega-Platform Play

The most direct form of re-bundling is when a single company combines its services into one package.

The Prime Example: The Disney Bundle. Disney was the first to master this. It offers a discount for subscribing to Disney+, Hulu, and ESPN+ together. This strategy serves multiple purposes: it uses ESPN’s stronghold on live sports and Hulu’s broad entertainment appeal to prop up the more niche Disney+, while increasing the overall revenue from each customer and reducing “churn” (the rate at which customers cancel).

The Emerging Powerhouse: Max. The merger of Discovery+ and HBO Max into “Max” is a classic content bundle. It combines HBO’s high-prestige, “appointment television” with Discovery’s massive library of low-cost, high-engagement reality TV (“90 Day Fiancé,” “Fixer Upper”). This creates a service with something for almost every mood, making the subscription more “sticky” and justifying price hikes.

2.2 The External Bundle: The Telco and Third-Party Partnership

This is where the new model most closely resembles the old. Streaming services are partnering with companies that already have a billing relationship with consumers.

- Verizon and Netflix: For years, Verizon has offered free or discounted Netflix subscriptions with its unlimited plans.

- T-Mobile and Apple TV+: T-Mobile has included Apple TV+ and other perks in its “Magenta” and “Go5G” plans.

- Comcast and Peacock: As part of the NBCUniversal family, Comcast often bundles Peacock Premium with its Xfinity internet and TV plans.

These partnerships are a win-win. The telecom company gets a valuable perk to reduce customer turnover, and the streamer gets a steady stream of subscribers and monthly revenue, often without having to spend on marketing to acquire them.

2.3 The Vertical Bundle: Integrating Live TV and FASTs

The landscape is also stratifying into distinct tiers, creating a new kind of bundle within a single app.

- Premium Subscriptions (SVOD): Your standard, commercial-free (or light-ad) tier like Netflix Premium or Disney+.

- Ad-Supported Tiers (AVOD): Nearly every major streamer now offers a cheaper, ad-supported plan. This has become a critical revenue driver, tapping into the lucrative advertising market and appealing to price-sensitive consumers.

- Live TV Integrations: Services like Hulu + Live TV and YouTube TV are themselves bundles, recreating the cable package but over the internet.

- Free Ad-Supported Streaming TV (FASTs): Platforms like Tubi, The Roku Channel, and Pluto TV offer entirely free, channel-based viewing supported by ads. They are becoming a new “basic cable” layer, often bundled into smart TVs and devices.

The modern streaming ecosystem is starting to look like a choose-your-own-adventure version of the old cable model: a base FAST layer, a middle layer of ad-supported subscriptions, and a premium tier of commercial-free services, all potentially bundled with your internet or phone bill.

Read more: The Future of the Silver Screen: Can the Theatrical Experience Survive?

Part 3: The Wallet Impact – What the Re-Bundling Means for You, the Consumer

So, is the Great Re-Bundling good or bad for your finances? The answer is nuanced.

The Potential Upsides:

- Convenience and Simplified Billing: Getting multiple services through one provider (like your wireless carrier) can simplify your monthly payments and reduce the hassle of managing numerous accounts.

- Perceived Value and Discounts: Bundles often come at a discount compared to subscribing to each service individually. The Disney Bundle can save a household over $10 per month.

- Increased Discovery: Being in a larger content ecosystem, like Max, can help you discover shows you wouldn’t have sought out on a standalone service, increasing the value you get from your subscription.

The Significant Downsides:

- The Creeping Cost of “Sticky” Subscriptions: The primary goal of a bundle is to reduce churn. When a service is bundled with your cell phone plan, you’re less likely to cancel it, even if you’re not using it much. This “set-it-and-forget-it” mentality leads to passive subscriptions that drain your bank account monthly. This was a core criticism of the old cable model.

- The Return of the “Faux À La Carte” Model: We are moving back toward a system where you pay for a large package to get a few key things you want. You might want Max for “House of the Dragon” but have no interest in reality shows, yet you’re still paying for the entire library.

- Inevitable Price Hikes: As bundles become the norm and competition decreases, the power shifts back to the providers. We are already seeing aggressive price increases across all major platforms. Bundling makes these hikes more palatable, as the pain is distributed across several services, but your total monthly entertainment cost still rises.

- The Aggressive Push of Advertising: The rapid adoption of ad-supported tiers is a double-edged sword. While it offers a lower price point, it fundamentally changes the viewing experience that made streaming so appealing. Furthermore, there is a strong incentive for companies to make the ad-tier the “default” option and to gradually increase the ad load over time, mirroring the evolution of cable and Hulu.

Part 4: The Future Landscape – Predictions for the Next Five Years

Based on current trends, we can project where the Great Re-Bundling is headed.

- Consolidation is Inevitable: The market cannot support seven+ major streaming services. We will likely see mergers and acquisitions. A combined Paramount+ and Peacock, for example, suddenly looks like a powerful, broad-content competitor.

- Sports as the Ultimate Bundle Anchor: Live sports is the last bastion of must-watch, real-time television. Services will use exclusive sports rights (like the NFL on YouTube TV or NBA on Max) as the cornerstone of their most expensive bundles, much like ESPN did for cable.

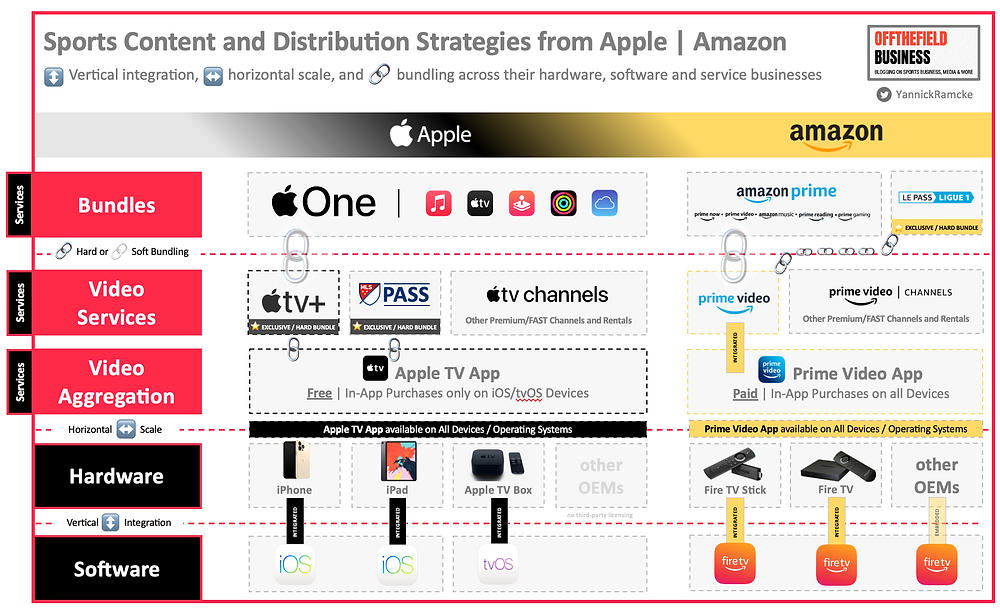

- The “Super Aggregator” Will Emerge: The next battle will be won by the company that best aggregates all these services. Roku, Amazon Fire TV, and Apple TV already try to do this, but the winner will be the platform that offers the simplest universal search, viewing guide, and single billing for all your subscriptions.

- A Hybrid Model Will Dominate: The future consumer will likely maintain a small core bundle of 2-3 services year-round (e.g., The Disney Bundle) and then “churn” the rest—subscribing to Max for a month to binge a new season, then canceling and switching to Netflix for the next, in a constant rotation.

Conclusion: Navigating the New Reality

The Streaming Wars promised a revolution but ended in a restoration. The “Great Re-Bundling” is, in many ways, the industry correcting its own over-enthusiasm and returning to the stable, profitable economics of the bundle. While this offers some convenience and short-term discounts, the long-term trajectory points toward higher costs and less flexibility for consumers.

The empowerment we felt a decade ago is now our most important tool. To protect our wallets, we must become active, not passive, subscribers. This means:

- Audit Your Subscriptions Quarterly: Are you actually watching what you’re paying for?

- Embrace the Rotating Door: Don’t be afraid to cancel a service after binging its flagship show. You can always resubscribe later.

- Leverage Bundles Wisely: Seek out legitimate discounts through partnerships you already use (like your cell phone plan) but be wary of bundles that lock you into services you don’t need.

- Consider Ad-Tiers Pragmatically: If you can tolerate commercials, the ad-tier can be a great cost-saving tool. Just be prepared for the ad load to potentially increase over time.

The Great Re-Bundling is here. By understanding the forces behind it, we can make informed choices, optimize our spending, and ensure that the future of television remains in our control, not solely in the hands of corporate boardrooms.

Read more: From Indie Darling to A-List Star: The Meteoric Rise of Paul Mescal

FAQ Section

Q1: What exactly is the “Great Re-Bundling”?

A: The “Great Re-Bundling” refers to the current trend in the streaming industry where media companies are combining their standalone services into packages or partnering with other companies (like telecom providers) to offer them together. This is a shift away from the previous era of numerous independent streaming services (“the Streaming Wars”) and mirrors the bundled package model of the old cable TV system, albeit in a more digital and flexible form.

Q2: Is re-bundling good or bad for consumers?

A: It’s a mixed bag. It can be good in the short term by offering convenience and discounted pricing for multiple services. However, the long-term risks include higher overall costs, less flexibility, and “sticky” subscriptions that you forget to cancel. The goal for providers is to reduce your willingness to cancel, which can lead to you paying for services you don’t actively use.

Q3: How can I save money in this new bundled era?

A: Be proactive:

- Rotate Your Subscriptions: Subscribe to a service for a month or two to watch what you want, then cancel and move to another.

- Audit Your Bills: Regularly review your bank statements and cancel unused subscriptions.

- Choose Ad-Supported Tiers: If commercials don’t bother you, this can cut your monthly costs significantly.

- Look for Legitimate Bundles: Take advantage of bundles offered through your wireless carrier or other partners, but only if you actually want the services included.

Q4: Are we just going back to cable TV?

A: Not exactly. The new model is more flexible than traditional cable. You are not locked into long-term contracts, and you have more control over which “bundles” you adopt. However, the economic principles are similar: packaging products together to increase revenue and customer retention. The fear is that we could eventually end up with a system that has all the downsides of cable (high cost, bloated packages) with fewer of the benefits.

Q5: What is a “FAST” and how does it fit in?

A: FAST stands for “Free Ad-Supported Streaming Television.” These are services like Tubi, Pluto TV, and The Roku Channel that offer free live channels and on-demand content supported by ads. They are becoming the new “basic cable”—a free or very low-cost entry point into the streaming ecosystem that is often bundled into smart TVs and streaming devices.

Q6: Why is everyone suddenly offering an ad-supported plan?

A: After years of focusing solely on subscription revenue, streamers hit a ceiling on subscriber growth. Introducing ad-supported tiers allows them to:

- Attract price-sensitive customers who would not pay for a full-price plan.

- Double-dip on revenue—they get your subscription fee and money from advertisers.

- Justify future price increases on the premium, ad-free tier, creating a wider gap between the two offerings.